The Big Retirement Question: How much money will I need?

One million? Two million? Everybody wants to know how much money they will need to retire, but to answer that question, here are some things you may need to figure out first.

“Well, it depends.”

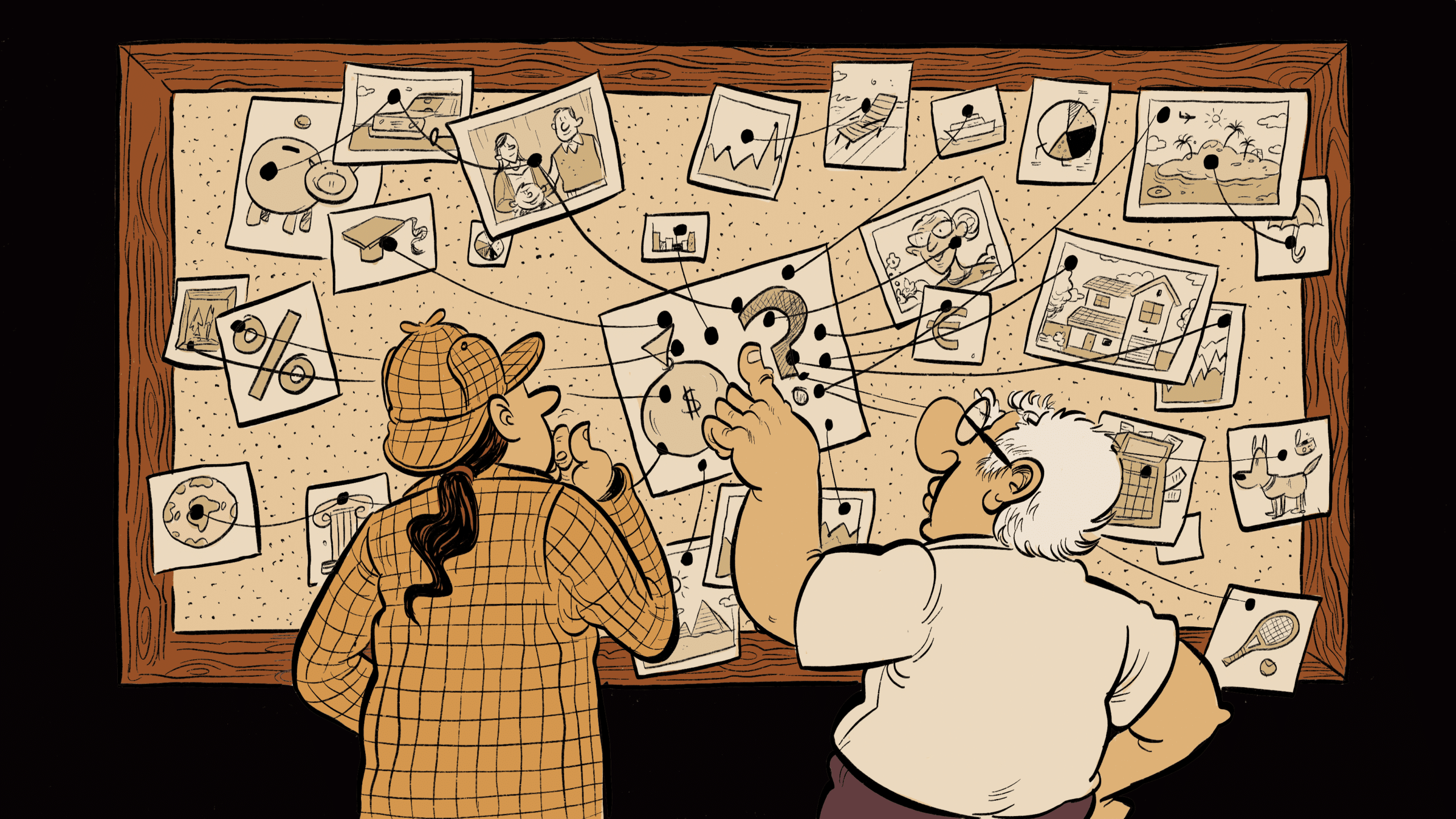

Natasha Kovacs knows that some clients are looking for a more definitive answer when they ask her the Big Retirement Question: How much money will I need?

But while the Senior Financial Planner with TD Wealth knows some clients can get frustrated when they hear her answer, she says she would be doing them a disservice if she gave a “one number” reply. People may look for the confidence of having a single succinct answer, but Kovacs says it can’t be found in a dollar figure pulled out of thin air.

“If you’re asking me, ‘Is $1.5 million enough?’ then I need to ask you more questions,” she says. “It’s only by interacting with you, learning about your situation and finding out what you want to do in retirement that I’ll be able to give you the answers you want.”

One number can’t begin to reflect the many overlapping financial and lifestyle decisions and calculations that make up a great retirement plan, she says. As an example, how often you plan to buy a new car in retirement (every three years? 10 years?) can impact how frequently you draw down your savings. And that, in turn, can influence how much money you have to deal with financial obligations or pursue retirement activities you are interested in.

In order to answer this Big Retirement Question, Kovacs says, you need to first consider a host of other variables. A partial list includes savings plans, cash flow, spending habits, corporate and government pensions, downsizing your home, retirement date, tax strategies, debt, family responsibilities, charitable donations and estate planning. Only when you take a closer look at these factors can your future retirement become clear.

Here are five exercises that Kovacs suggests you consider doing before you land on your own answer to the Big Retirement Question.

Examine your saving and investing strategy

If you ask Kovacs, “How much should I save and invest?” she’ll look you in the eye and reply, “Well, are you a big saver, someone who saves a little or someone who has never saved a penny in their life?” Your answer to this question can begin to reveal how much planning needs to happen before retirement.

To help clients get started, advisors like Kovacs can take information about their financial lives and project the results out into their 90s. Within this analysis, Kovacs even notes how her clients’ situations could change depending on differences in income, expenses and other factors like taxes. She can manipulate the data to show how changes in spending or saving can impact clients well into retirement.

Exactly when you want to retire needs to be considered, as well as the date at which you expect to begin drawing on your savings and whether or not you plan to downsize your home. A big factor, and one that is increasingly relevant, is whether or not you intend to help your children financially along the way. That could mean helping them buy a house or helping pay for higher education.

Plan your lifestyle in retirement

If you want to know how much you need to save for retirement, you will need to consider what it costs to be retired. For example, Kovacs says that anyone who dreams of travelling somewhere warm each year should also consider the costs of out-of-country health care for seniors: It’s only getting more expensive. It’s that level of attention to financial detail Kovacs says that people need to consider when planning their lifestyle in retirement.

"A big factor that is increasingly relevant is whether you plan to help your kids financially"

Another area to note is home maintenance: You may enjoy gardening now, but as you get older, you may want to pay for someone else to shovel snow and clean the eavestroughs. Finally, though it can be hard to think about when your kids are still small, someday you may have grandkids to spend money on (or to travel to for a visit).

To help ensure you’re adequately prepared, she says everyone should make a list of the things they want to do in retirement — golf membership? RV fees? — and include other day-to-day costs. For her part, Kovacs can add the items you haven’t considered (like those health care costs) and then it’s back to the projection tables to see whether your savings and investments are on track.

“Let’s bring your ideas to light based on the lifestyle you envision,” she says.

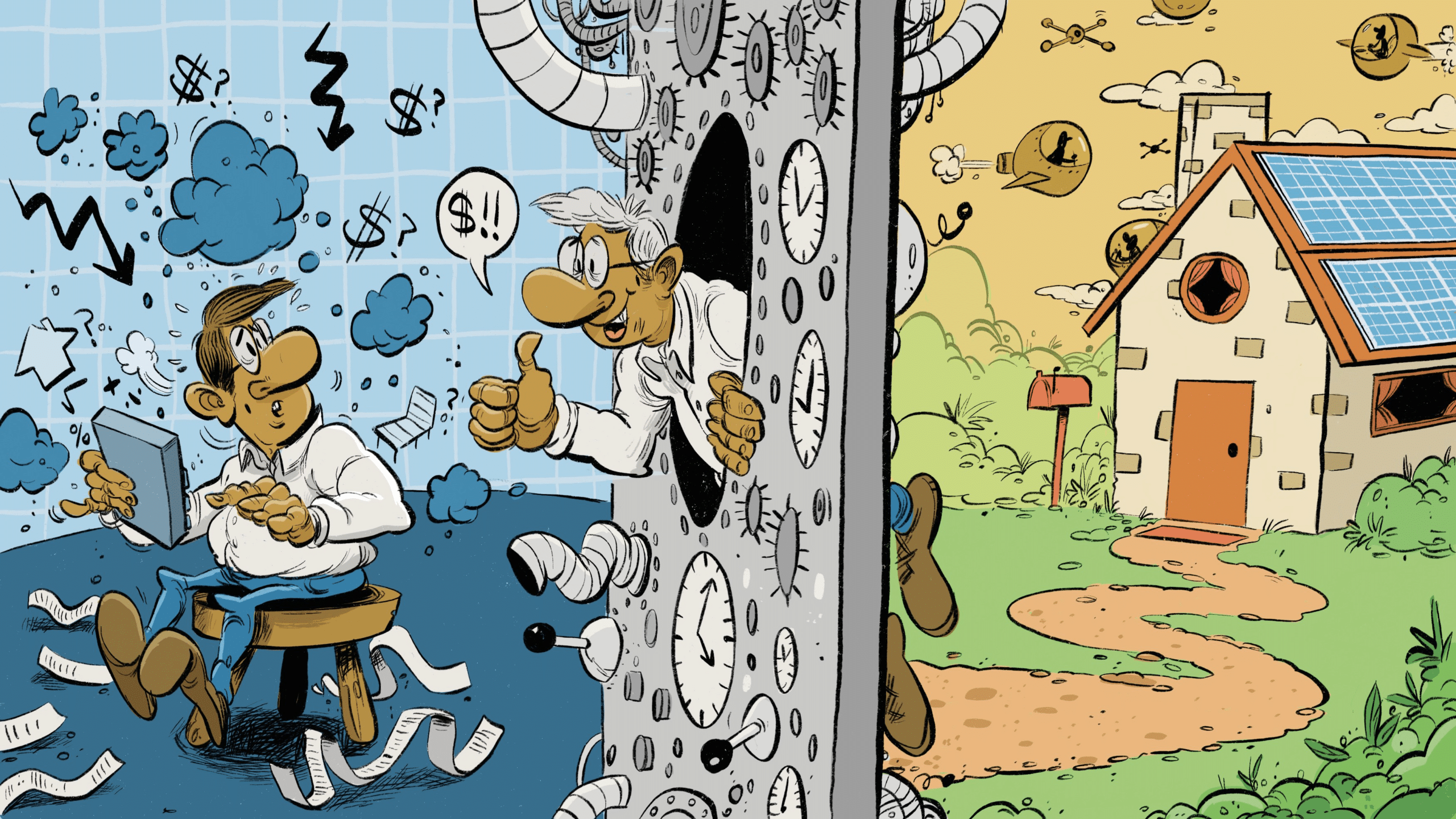

Start considering now when you want to retire

This is a highly personal decision, yet it can have a large impact on your finances. Deciding when to retire means transitioning from one type of life to another and it requires a thorough discussion about your health, life outlook, goals and finances. If you retire from an established career, one option is to continue working at something you enjoy more even if it does not bring in as much money. You could also decide to work part-time to keep busy and bring in some extra cash. Ultimately, the moment you begin withdrawing savings instead of contributing is pivotal. While retiring earlier can mean stretching your savings for a longer period of time, retiring later can mean working for longer but also potentially saving more.

Kovacs says that the age at which you retire can be a huge and complex decision and the financial details must complement it. She says once you decide on a time you think you should retire, an advisor can look at the numbers and let you know whether your personal outlook is in line with your financial projections.

Reflect on family responsibilities

Retirement is often portrayed in the media as a time when your responsibilities end and you can begin to spend your days walking along sandy beaches with your partner. The reality, Kovacs says, is that many retirees continue to have responsibilities, including helping their own elderly parents, supporting their grown children or both at the same time. With housing already so expensive and the cost of senior accommodation rising, people are concerned their own parents may not be in a position to receive the care they deserve. Or they may wish to ensure their grandchildren have funds available for education.

These types of expenses may not be on your radar today, but they could eventually be draining. Kovacs says a family meeting may be in order to find out just what kind of situation your loved ones are facing.

“I always ask my clients to look into their parents’ care coverage,” Kovacs says. “They should review their benefits. Do they have at-home care covered? Do they have additional coverage for provincially covered facilities?” If not, now may be a good time to plan for their future care.

Be aware that you may be neglecting something important

Kovacs says that while people often dream about the day they retire and what they’ll do afterwards, some forget to check with their spouse or partner to see if they are on the same schedule. Or, if people want to know how much they need to retire, few ask about being tax efficient. Other people want to help their children get a start in life, but neglect to think about who will pay for their own enhanced health care and accommodation if they live to be 95. She says these are the sort of issues that Canadians should be planning for, but she also emphasizes that everyone’s situation is unique. Until you consider how your retirement will impact the next 30 years of life, a key part of your financial plan will remain missing.

Besides, she says, if recent years have taught us anything, it’s that our circumstances can change rapidly. It’s those concerns too that underline the need for a robust plan that can weather any financial storm.

DON SUTTON

MONEYTALK

ILLUSTRATION

DANESH MOHIUDDIN